A Fifth Third Debit Card is a valuable financial tool that provides easy access to your bank account. However, before you can start using this card, it needs to be activated. Activating your Fifth Third debit card is a simple process that can be completed online via the 53.com activation webpage. This article will provide a detailed step-by-step guide on how to do this.

Preparing for Activation

Before you proceed with the activation, ensure that you have the following:

- Your new Fifth Third Debit Card: You will need the card details, such as the card number, expiration date, and the CVV number on the back of the card.

- Your Fifth Third Online Banking Account: You’ll need your User ID and Password for the activation process. If you don’t have one, you can create one on the Fifth Third website.

Activating Your Fifth Third Debit Card

After confirming that you have the required information, follow these steps to activate your Fifth Third Debit Card:

- Open Your Browser and Navigate to the Fifth Third Website

Go to your preferred web browser and type in ‘www.53.com‘ in the address bar and hit enter.

- Accessing the Activation Page

From the Fifth Third Bank home page, look for a tab or button that says something like “Activate Card.” If you cannot locate it on the homepage, you can use the search function available on the site and type in “Activate Card.” Click on the search result that leads you to the activation page.

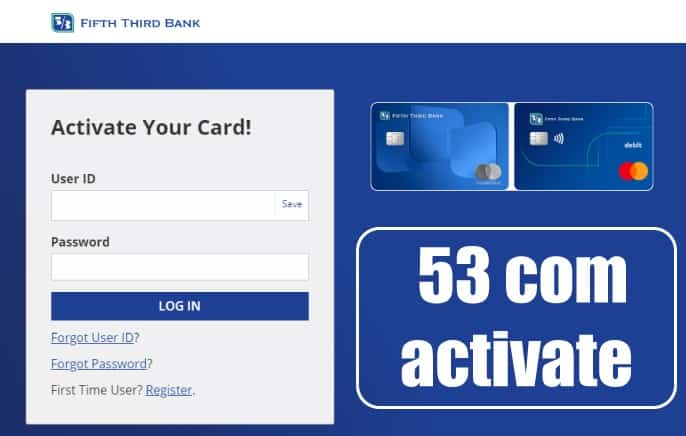

- Log in to Your Fifth Third Online Banking Account

On the activation page, you’ll be prompted to log in to your online banking account. Enter your User ID and Password in the required fields and click on the “Log In” button. If you don’t have an online banking account, follow the prompts to create one.

- Enter Your Card Details

After logging in, you’ll be directed to a page where you will enter your card details. Fill in the required fields, such as your card number, CVV, and expiration date. This information is found on your debit card.

- Confirm Your Identity

For security reasons, the bank may require you to confirm your identity. This could involve answering security questions that you set up when opening your account. Alternatively, you may be asked to confirm your identity via a text message or email verification code sent to your registered phone number or email address.

- Confirm Card Activation

After entering your card details and confirming your identity, click on the button to activate your card (this may say something like “Activate Card” or “Confirm Activation”). The website will process your request, and you should see a confirmation message stating that your card has been activated.

After Activation of Your Fifth Third Debit Card

Activating your Fifth Third Debit Card is the initial step, but what comes next? In the period after activation, there are several steps to ensure your banking experience is as smooth and secure as possible. Let’s discuss what you should do after successfully activating your debit card.

- Sign the Back of Your Card

The first thing you should do after activating your card is to sign the back of it. This is an additional security measure that can help protect you in case your card is lost or stolen. If your card is unsigned, someone could potentially sign it and use it.

- Memorize Your PIN

Your Personal Identification Number (PIN) is an important part of your card security. Do not write it down, especially not on your card, and never share it with anyone. You will use your PIN for ATM transactions and some types of purchases, so memorize it.

- Monitor Your Account Regularly

With your card activated, you can start making purchases and other transactions. It’s important to regularly monitor your account to ensure all the transactions posted are accurate. You can do this by logging into your online banking account on 53.com or via the Fifth Third mobile app.

- Set Up Account Alerts

Account alerts can help you stay on top of your account activities. You can set up alerts for things like low balance, unusual account activity, transactions exceeding a certain amount, and more. This can help you spot any suspicious activities early.

- Download and Use the Fifth Third Mobile App

For easier account management, consider downloading the Fifth Third mobile app on your smartphone. This will allow you to check your balance, transfer funds, deposit checks, and more from anywhere.

- Use Your Card Regularly

Regular use of your card will keep it active. If you don’t use your card for a long period, the bank might consider it inactive and might deactivate it.

- Keep Your Card Safe

Lastly, ensure that you keep your debit card safe. Avoid situations where your card details might be seen by others, and be cautious when using ATMs or payment machines. If you lose your card, report it to Fifth Third Bank immediately to prevent unauthorized access.

What to Do If You Encounter Problems with Your Fifth Third Debit Card Activation

While the process to activate your Fifth Third Debit Card is typically straightforward, you may encounter some problems. Here are steps you can take to address common issues:

1. Issues with Online Banking Login

If you’re having trouble logging into your online banking account on the Fifth Third website, here are a few things you can do:

- Forgot your User ID or Password: Use the ‘Forgot User ID/Password’ link available on the login page. You’ll be guided through the steps to reset your password or recover your User ID.

- Account Locked: After several unsuccessful login attempts, your account may be temporarily locked as a security measure. You’ll need to contact Fifth Third Bank’s customer service for assistance.

2. Issues with Card Details

If you’re experiencing issues entering your debit card details:

- Typing Errors: Make sure that you’re typing the card number, CVV, and expiration date exactly as they appear on your card. Avoid any spaces or dashes.

- Card Details Not Accepted: If the website isn’t accepting your card details despite being entered correctly, contact Fifth Third Bank’s customer service.

3. Identity Confirmation Issues

You may face problems while confirming your identity. If this happens:

- Security Questions: Ensure you’re entering the correct answers to your security questions. These answers are case sensitive and should be entered exactly as you set them.

- Verification Code: If you’re not receiving the verification code via text message or email, double-check that your contact information on file with the bank is correct. If it is and you’re still not receiving the code, contact customer service.

4. General Website Issues

If the website isn’t functioning properly or you’re experiencing technical issues:

- Browser Compatibility: Try using a different web browser, or clear your browser cache and cookies and try again.

- Website Down: If the website appears to be down, it may be a technical issue from the bank’s side. Wait for some time and try again later.

Contacting Fifth Third Bank Customer Service

If you’re unable to resolve the issue on your own or the problem persists, contact Fifth Third Bank’s customer service for assistance. You can find their contact information on the 53.com website. Be prepared to provide details about the problem you’re encountering so they can assist you effectively.

Conclusion

Activating your Fifth Third Debit Card is a straightforward process that can be completed on the 53.com activation webpage. By following these steps, you can swiftly activate your card and start making transactions. Remember to keep your card and account details secure to protect your financial information. Happy banking!